No wonder the

original plan what plan? was only three pages long. It turns out that

there was no plan. When I heard the news that Treasury had reversed course on the Troubled Asset Recovery component of the Troubled Asset Recovery Plan, that and writing an article with the above title were the first things that popped into my head. Sadly, those two things were also all I could think of while I was cowering under my desk, without food and water, waiting for it all to end. REITs of course got absolutely crushed, and now it looks like many REITs are now headed for the dreaded ".BB" designation. I keep hoping in vain to someday drown in dividends, but that's unlikely to happen if REITs are swimming in the Pink (sheets that is).

The story of the insanity in commercial mortgages that ensued after the about face now been covered everywhere, including the

Wall Street Journal, the

Washington Post, and Bloomberg, which was the most strident in

blaming it all on Paulson. Sadly, spreading blame won't help; only spreading money will (and maybe some Prozac too, if I could only afford to see the doctor).

What follows is a relatively cogent article consisting of the most juicy bits from those three above articles.

"A lot of very foolish loans were originated between 2005 and 2007, and many of those loans begin to mature in 2010," said Mike Kirby, director of research at Green Street Advisors, a commercial real estate research firm. "You have a significant amount of debt maturing at that time and yet you don't have a market to replace that debt."

The price of commercial real-estate-debt securities has fallen so far that it has set off a debate among investors as to whether now is the time to get back into the market. Triple-A commercial mortgage-backed securities are trading at roughly 70 cents on the dollar, meaning they would produce a 20% return if held to term.

The default rate on commercial mortgages remains near its historical low, although it is increasing. Overall, the number of commercial mortgages packaged into securities that are 30 days or more past due rose to 0.64% in October from 0.39% at the end of last year. That is the highest delinquency rate in two years but still far from the kind of carnage that occurred during the commercial real-estate collapse of the early 1990s. Back then the cumulative default rate on loans made in 1986 reached 36%.

The trading levels of CMBS bonds imply a cumulative loss rate of as much as 40% on top-rated bonds, which means that at least 70% of the underlying loan pool would have to go into default, [emphasis added] said Richard Parkus, head of CMBS research at Deutsche Bank Securities Inc. But he, like other market observers, views that as an unlikely scenario. ...

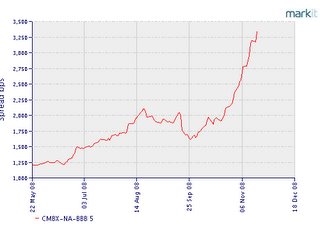

The spreads between the CMBX, a credit market index that tracks the values of commercial real-estate bonds, widened to another record level Thursday. And CMBS bonds with triple-A ratings now yield more than 14 percentage points above yields on 10-year U.S. Treasury notes, according to Trepp, a New York company that tracks the commercial real-estate-finance market. That compares with a 1.5 percentage point spread one year ago and an 8.3 percentage point spread just one week ago.

At current prices, all the loans could default within 18 months and a buyer wouldn’t lose money, according to Lisa Pendergast, an analyst at the Greenwich, Connecticut-based unit of Royal Bank of Scotland Plc. That’s assuming foreclosure recoveries of 37 percent, compared with the typical 60 percent.

“The default levels implied by where these bonds are trading mean we will all be living in boxes,” said Eric Johnson, president of 40/86 Advisors Inc. in Carmel, Indiana.

“There is evidence that short-sellers are targeting this market because they know they can push it around,” said James Grady, managing director in New York at Deutsche Asset Management, which has about $240 billion of fixed-income assets under management.

“Recent speculative conditions reminds us of the summer when oil was $140 a barrel, and many parties were calling for $200,” Darrell Wheeler, of Citigroup wrote. “Commercial real estate conditions are deteriorating, but we cannot justify recently cheap levels.”

Let's hope so. I have bills to pay.