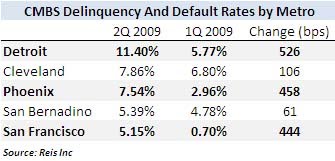

San Francisco, once considered one of the strongest commercial real estate markets in the country, had one of the largest increases in overall CMBS default rates in the second quarter of 2009, up 444 basis points to 5.15% (and yes, this was even worse than Miami). Detroit was still the worst performing market, with an overall CMBS default rate of 5.62%, up 562 basis points from Q1. However, San Francisco’s multi-family sector now has a CMBS default rate of 21.7%, which is almost double the 12.93% multi-family delinquency rate in Detroit.

The amazingly high default rate in multi-family is being driven by one just one buyer and a lot of brokers in nice suits. Well known for not only paying top dollar (over 20 times gross rents) but also for pursuing, shall we say, aggressive retenanting programs, this buyer actually pocketed 75% of all San Francisco apartment properties that traded in 2007. And who is surprised? At 20 times gross rent, anybody who wasn’t selling was living under a rock. About $1.2 billion was “invested” from 2003 through early 2008, financed primarily with two year, interest-only, cross collateralized debt complete with personal guarantees who’s your daddy now?

The answer is UBS, which has already taken back about 1,500 units, and CIM, which bought the senior debt on 24 properties from Credit Suisse. This is only the tip of the iceberg though, and so far only about 700 units have actually been sold to new buyers. San Francisco apartment brokers, who were only too happy to cheer 20 GRMs on the way up, are now complaining publicly about comps that are “artificially low”. Predictably, the view on that side of the fence is not that this guy overpaid, but that he simply over-levered! That aside, I’ll give you one guess where prices in San Francisco are heading:

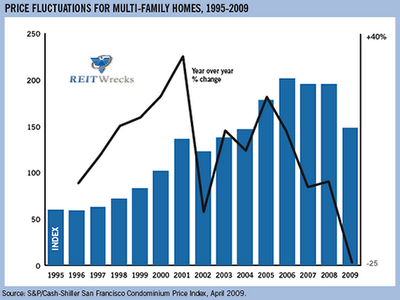

Despite the mess in San Francisco now, the S&P/Case-Shiller Index for Bay Area multi-family prices shows a 10.83 percent growth rate from the year of its inception (1995) through 2002. Growth in prices was strongly influenced by the Bay Area’s healthy population growth, and as a result growth in Bay Area multi-family prices far outstripped the S&P/Case-Shiller Index for the top 10 metropolitan areas over the same period.

Unlike some cities in the Lone Star state, for example, where increased supply typically rises to the occasion, Bay Area multi-family prices have been influenced by a fundamental supply and demand imbalance even before the credit/real estate hysteria of 2003 through 2006. Between 1987 and 2002, the Bay Area population increased by 18 percent. The growth was fairly evenly spread over nine Bay Area counties, with Solano County having a growth rate of 28 percent, which was the highest growth rate in the area. The largest population growth in terms of total residents occurred in Santa Clara County, which added 301,000 people, followed by Alameda County and Contra Costa County, both of which added approximately 250,000 people. Combine that with natural and political barriers to unfettered new development, and Northern California doesn’t look so awful even in you’re a Bears fan.

Granted, the current San Francisco foreclosure saga is far more interesting than plodding through Bay Area demographic statistics. But when all those “artificially low” comps get set, is there any place you’d rather be with your money?

reits investing

apartment reits

reit stocks

reits

ShareThis

ShareThis

{ 1 trackback }

{ 0 comments… add one now }