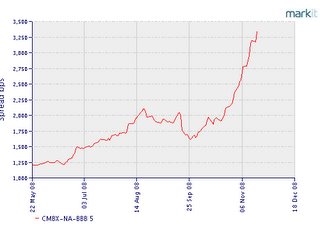

Part of the reason for the distress in the index and also the basement-dwelling stock prices of many Mortgage REITs is that two very large loans that were securitized into CMBS, including one loan secured by two Westin hotels, appear to be nearing imminent default. Of course, this distress is also due to the forced selling of anything that hasn’t already been seized by the county sheriff.

The $209 million Westin loan is backed by two hotels located in Tucson, Arizona, and Hilton Head, South Carolina. The slowing economy has hurt hotel operators as consumers and businesses have cut back on travel. The second loan nearing default is a $125 million loan for The Promenade Shops at Dos Lagos, which is located in Corona, California. Southern California has been dealt a particularly heavy blow by the worst housing crisis since the Great Depression.

Credit Suisse analysts reported that the Weston loan is split between two JPMorgan-issued CMBS deals. J.P. Morgan Chase Commercial Mortgage Securities Trust 2008-C2, the more recent of the two deals, is heavily exposed. That trust’s portion of the defaulting Westin loan represents 8.9% of the total collateral pool. Unfortunately, the bad loan on the Promenade Shops is also the largest loan in the same pool, representing fully 10.7% of the collateral. This means two of the top-ten largest loans in the pool, representing almost 20% of the collateral, are about to default. Investors in all but the most senior tranches of this issue are now facing huge losses as remaining cash flows are diverted to those who occupy higher ground (see the post “What is Securitization” for more detail on how subordination impacts Mortgage REITs).

It is not surprising that hotel and retail loans would come under pressure, particularly a retail loan made in Southern California, which was practically the belly of the beast. Hotel occupancies and retail sales have been especially hard hit as consumers and businesses snapped wallets shut when the credit crisis started making what Ross Perot could only have described as that “giant sucking sound”.

The real interesting aspect of these latest defaults is that everyone involved should have known better. Yet the pressure to produce, rate and sell still seems to have trumped the mirrors in front of our faces.

All of the mortgage loans in the pool were originated between June 27, 2007 and April 30, 2008, and the securitization closed on May 8, 2008, well after the Bear Stearns collapse and Ralph Cioffi scapegoat perp walk was led away in handcuffs.

Nevertheless, the Westin loans were interest-only for 36 months and had underwritten debt service ratios (DSCR) at closing of less than 1.25%. This would have been considered risky even in 2006. The loan agreements on the Promenade Shops were interest-only for 60 months and had underwritten DSCR of just 1.10%. The Promenade loan also allowed additional subordinated debt provided that the combined LTV did not exceed 85% and the combined DSCR did not fall below 1.00%. This is the equivalent of allowing someone to rent an apartment that will consume 100% of their monthly take-home pay (assuming a landlord would let anyone do such a thing). More than 75% of the loans in the pool were interest-only or partial-interest only. Other large loans in the pool include the Las Vegas headquarters of Station Casinos good luck and several other large retail and hospitality properties.

One would have thought, given the media and political spotlights around shoddy underwriting and hopelessly conflicted ratings agencies, that underwriting standards would have improved and that CMBS investors would be taking a much harder look at the bonds being furiously shoveled in their direction.

So is it really any wonder that Mortgage REIT stocks are in the tank when two of the top-ten largest loans in a May 2008 CMBS deal, representing almost 20% of the collateral, have gone up in smoke in just six short months?

Click here for an updated Mortgage REIT list, including current yields.

ShareThis

ShareThis

{ 2 trackbacks }

{ 0 comments… add one now }