As the world was coming to an end in March of 2009, REITWrecks wrote a rather forward-leaning post entitled REIT Stocks: 4 Ways to Play the Carnage.

REITs have rallied strongly since then, and even more strongly since Direxion launched its new levered REIT ETF series in early July. The launch could not have been more well timed. DRN (shown in green, below) is up more than 160% in just six short months:

However, our somewhat disturbing obsession with Real Estate Investment Trusts shouldn’t obscure a basic truth: REITs are strongly correlated to the broader stock market, and they are often even more volatile than stocks. If you are an asset allocator seeking diversification, and you include REITs as a substitute for direct investments in real estate, your portfolios suffered badly in 2008 and 2009.

Although REITs were thought to help Mom and Dad sleep soundly, Freddy Krueger can actually make a lot of noise in the inky black night. In the darkest days of September 2008 through March of 2009, according to the Wall Street Journal, the Dow Jones Equity All REIT Index closed up or down by more than 5% on 64 occasions. REITs are typically more volatile than direct investments, but this kind of volatility is unprecedented. Since its inception in 1990 through the end of 2007, that had happened only three times.

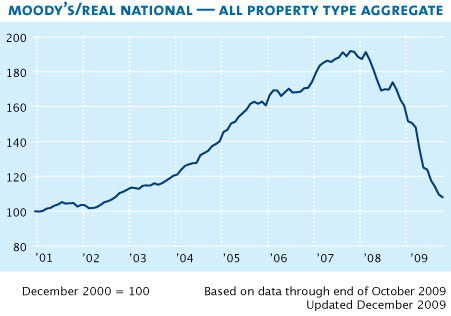

As far as correlation goes, not only did REITs experience three times more negative return years than privately held real estate (1972-2000), but the magnitude of negative REIT returns was much greater than privately held real estate (read the full study here). What’s the last word on correlation? Why bother with words when one can simply use pictures. Compare Direxion’s performance chart above with Moody’s Real Property Price Index below:

What’s the point? Simple: it’s time to buy commercial real estate. If you’re an asset allocator, REITs are a flawed substitute for direct investments in real property. However, they are also known as a leading indicator for the real property markets, and REITs often lead real property into and out of deep valuation troughs. If you use REITs as a substitute for direct investments in real estate, it may be time to re-evaluate that strategy and buy the real thing.

reits investing

reits

reit stocks

ShareThis

ShareThis

{ 5 comments… read them below or add one }