Analysts See Apartment REITs Posting Strongest Effective Rent Gains In History

The Shadow Market Media Myth

While the RREEF report did not specifically refer to the "shadow market media myth", it's worth noting that the shadow market being written about today is much less troublesome than the one that existed in anonymity five years ago.

Back then, applicants with bad credit were routinely being turned down for $600 a month apartments only to walk across the street and get approved for $250,000 first mortgages, no questions asked. These liar loans were also being doled out to applicants with good credit just as fast as AIG could write credit default swaps on their mortgage bonds. Nobody Carlton Sheets on crack! could resist.

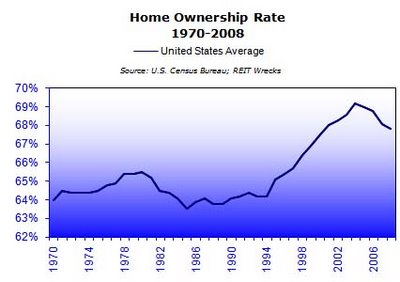

This unprecedented combination of fear and greed propelled the U.S. home ownership rate to record levels:

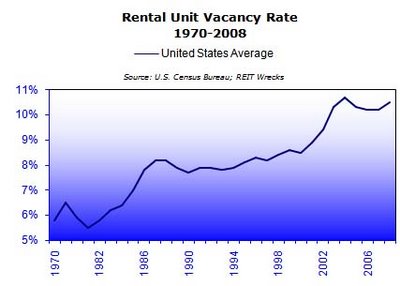

While briefly pushing nationwide average apartment vacancy rates above 10% in 2004:

** The increase in vacancy rates in the 1980's is partly due to tax laws which allowed passive loss deductions to offset earned income. The result was a mini-boom in syndications of real estate tax losses to individual investors. The Tax Reform Act of 1986 eliminated these incentives.

** The increase in vacancy rates in the 1980's is partly due to tax laws which allowed passive loss deductions to offset earned income. The result was a mini-boom in syndications of real estate tax losses to individual investors. The Tax Reform Act of 1986 eliminated these incentives.Naturally, all of this had a deleterious effect on the performance of apartment investments. RREEF's 2009 US Real Estate Investment Outlook asserts that the process of unwinding this credit-induced housing distortion in is about to begin, and that it will coincide with several powerfully favorable trends for Apartment REITs:

- Employment growth in 2011 will enable huge pent up demand for apartments by "echo boomers" and residents who doubled up during the recession. RREEF estimates that these two population cohorts are comprised of 75 million people, or approximately 25 percent of the US population;

- Immigration, forecast to continue at an average rate of 1.8 million annually, will be a sustained driver of demand for multi-family rental housing;

- New construction of multi-family rental housing is severely constrained by lack of financing. Deliveries are forecast to drop below 1993-1994 levels, which will facilitate quicker stabilization of occupancies; and

- Reversion to historical rates of home ownership will continue as financing is constrained and job seekers prefer mobility in order to pursue employment.

Apartment REITs Should Outperform

RREEF estimates that the massive government stimuli will take hold by late 2010. As demand snaps back, the short-term nature of apartment leases will allow owners to raise rents quickly, and the recovery in rental rates and occupancy levels may be without parallel. This should position Apartment REITs as the best performing of the four major property-sector REITs.

Look For Apartment REITs With Low Leverage

But don't look for all Apartment REITs to participate. Higher quality REITs will prevail as lower quality, highly indebted companies will fail or be purchased by stronger entities. REITs with the greatest risk of failure are those that are over-leveraged and exposed to weak markets. Weak metro areas are those with a severe housing imbalance in both for sale and rental product in tandem with the sharpest employment declines. These include Atlanta, Phoenix, Riverside, Jacksonville, Orlando and Tampa.

Look For Apartment REITs in Healthy Markets

Markets with the strongest prospects, in spite of some near-term pain, are Washington DC, Baltimore, San Francisco, Seattle, San Jose, New York, San Diego and Los Angeles. In general, RREEF says these markets were not excessively impacted by housing oversupply, but they will nonetheless experience some weakness due to continued expected job losses. In the longer-term, they should rebound with relative strength.

The Best Apartment REIT for 2009 includes a list of Apartment REITs by leverage level, including a sensitivity for increasing cap rates. Click here for a complete list of Apartment REITs, but avoid REITs paying dividends in stock.

apartment reits

apartment reitsreit investment

reit news

reits

reit investments

Labels: Apartment REITs, REIT Investments, REIT Stocks