REIS, a consulting firm boasting a peripatetic chief economist with the best enunciation I have ever heard, evidently supplied data to Bloomberg showing that commercial loan defaults will rise dramatically if property-level net operating incomes (“NOI”) drop by even 5%. That’s a rosy forecast, given what’s going on with the economy. For the time being however, let’s assume they’re correct because there is really no dispute that NOI will weaken in this environment.

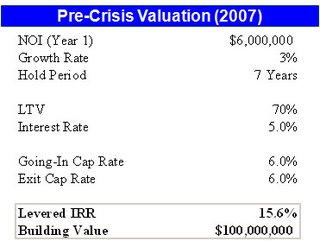

All things being equal, when NOI drops, the value of the underlying property also drops. Let’s say you own a property with $6 million in NOI. And let’s also say the “market” capitalization rate for that property is 6%, which is about where cap rates were, broadly speaking, during the boom. That means you have a property worth $100 million ($6MM in NOI/.06). However, if your NOI drops 5% to $5.7MM, your property is now worth only $95 million ($5.7MM/.06).

Could this really be what persuaded a bunch of New York City real estate tycoons to beg for a meeting, hats in hand, with a Senator from Brooklyn? Unfortunately, it wasn’t, because the above example assumes all else is equal, which is not the case. What if you threw in a few more wildcards, like the collapse of the CMBS market and rising cap rates? Then you’d have a story, and blessed be the prophets, it’s all right here on REIT Wrecks!

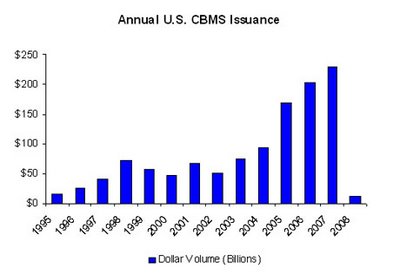

So what’s going on with the CMBS market? The short answer is nothing, really, and that’s a big part of the problem. During the boom years, CMBS grew to become a $225 billion source of capital to the commercial real estate market. Some were optimistically predicting that it would crash through $300 billion in annual issuance by 2008. What actually happened couldn’t have been more different, but it did crash.

The CMBS market actually collapsed, and commercial real estate lending volumes continue to contract. In fact, those 2008 deals you see on the chart, all $12.1 billion of them, were largely the result of lenders desperately trying to unload the loans they made in 2007. One of the last of those deals, J.P. Morgan Chase Commercial Mortgage Securities Trust 2008-C2, closed in May of 2008 and 20% of its commercial real estate loans defaulted within just 6 months.

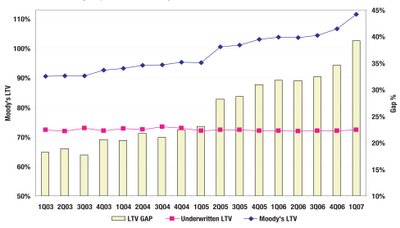

Clearly, huge demand for CMBS led to a decrease in underwriting standards, including (among other things), a relaxing of traditional loan-to-value criteria. Moody’s estimated that the gap between the Moodys LTV and underwritten LTVs reached record in the first quarter of 2007 (nearly 45%). The Moody’s estimate of actual LTV also reached a record of 106.5%.

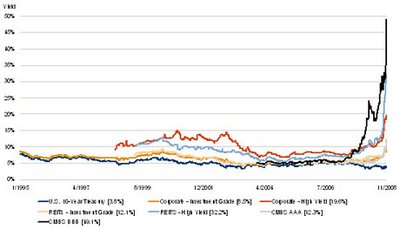

These poorly underwritten loans are still out there and in a few of short years, many of them will start to mature. Unfortunately, no lender will touch them now because they are practically radioactive. At the same time that a huge source of capital has disappeared from the market, borrowing costs have soared, making whatever capital there is out there relatively expensive. You can enlarge the chart a bit by clicking on it. Nevertheless, the lines going up and to the right tell the story: money is more much more expensive.

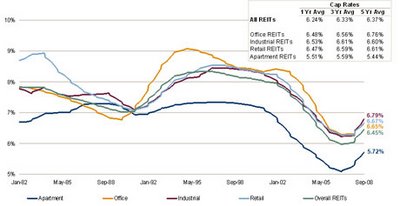

This is happening at the same time that cap rates, which were compressed down around that 6% mark, are now correcting. Cap rates averaged 8.3% between 1986 and 2008, but they fell below 6% in the first quarter of 2007.

This is a toxic mix for those New York City real estate tycoons, and the reason they made the trip to see Chuck Schumer from Brooklyn is simple: they are all about to lose a TON of money.

If NOI decreases by 5%, that’s a few less dinners at the Palace Hotel. However, if that happens at the same time that cap rates revert to historic averages and borrowing standards suddenly tighten, they can forget about dinner at the Palace because they’ll all be sleeping outside on the sidewalk.

Here is that $6 million in NOI at a 6% cap rate during the boom years. Everything looks great, and we’ve got our $100 million:

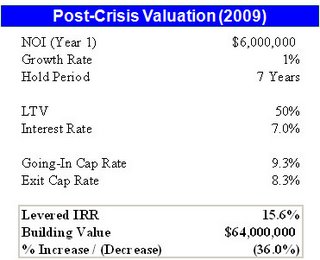

Ok, but what happens now that things have changed? If you still want your 15.6% Levered IRR (and that’s a big if), what would that deal look like today? Cap rates are definitely headed north, most likely back to their 8.3% average, and loan to values are definitely headed south, probably close to 50% for office and retail (Pro Logis recently did project level industrial debt at 50% LTV).

Adjusting for the new reality, that $100 million deal is $36 million in the hole. If NOI drops by 5%, the problem gets a whole lot worse. This is the wall against which many equity investors and developers have backed themselves into, particularly those with near-term debt maturities.

While REIS was emphasizing NOI growth, or lack thereof, in the Bloomberg story, the canary in the coal mine for the Wall Street Journal was Foresight Analytics warning about near-term debt maturities. The Journal’s story emphasised 2009 maturities that could have trouble getting refinanced. However, while there will definitely be demand for refinancing next year, it will start to get really interesting in 2010. About $180 billion in 2005-2007 CMBS loans will start to mature then, and a little more than half of those are variable rate deals. These are the Alt-A’s of the commercial world, and they were underwritten for a completely different solar system.

The good news is that if you’re a lender in the above example with a well-underwritten 70% LTV loan, things aren’t looking nearly so bad. You’re only down about 10%, and you get the asset to play with, while the developer/owner is completely wiped out. This could lead to the ultimate irony for all those that have been burned on Mortgage REITs: those loan defaults aren’t looking so bad after all! Thanks to Piping Rock Partners for compiling and assembling the data in this post

Disclosures: None at the time of publication

apartment reits, commercial real estate, commercial real estate debt, commercial real estate mortgages,reits

commercial real estate loans

ShareThis

ShareThis

{ 2 trackbacks }

{ 0 comments… add one now }