Approximately 80% of new 2008 loans were originated simply to refinance existing maturing mortgages, compared with just 35% from 2000 through 2007. This trend will only increase as record numbers of 2005-2007 vintage commercial mortgages begin to mature in 2010.

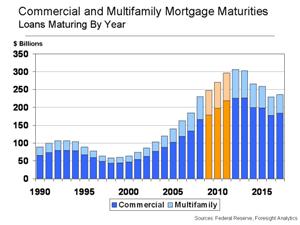

In 2009 alone, Foresite Analytics estimates that $250 billion of commercial and multifamily mortgages will mature. This is an all-time high for the real estate debt industry, but the record won’t last long. Over the next two years, $594 billion of commercial real estate loans will mature as aggressively underwritten 2006 and 2007 vintage loans come due. That is on top of $220 billion of multifamily mortgages scheduled to mature:

Many equity investors are likely to get wiped out in the tempest that will ensue when these loans mature, and I wrote about the math behind this certainty in The Coming Bust in Commercial Real Estate: Why Developers Are Desperate For the Dole. That post illustrated how a building worth $100 million at the peak is only worth $74 million now, but a 36% decline in value may be the best one could hope for these days. Yesterday, Bloomberg reported that lenders believe the value of the Hancock Tower in Boston may have declined by 50%

The commercial real estate market is now in a full-fledged tail spin. According to Real Capital Analytics, U.S. commercial real estate prices are falling at a similar rate to residential, down about 17 percent year-over-year. The reason is that $1.8 trillion of loans were originated in the U.S. between 2000 and 2007, with the most rapid growth taking place in 2005, 2006 and 2007. Roughly half of that debt was originated during 2004 and 2008, some of the worst years in terms of deterioration in underwriting standards. That debt is starting to come due right now, and there may not be enough new lending capacity to absorb it all.

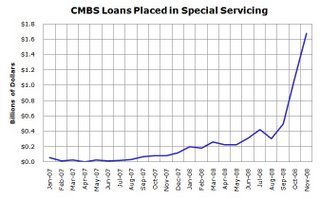

Many lenders are playing a game of hide the weenie by automatically granting one-year extensions on maturing loans in the hopes that debt markets will miraculously recover in 12 months. This has been almost standard procedure in the CMBS market, where maturing loans are being extended and placed into special servicing at ever increasing rates:

Source: Costar

Source: CostarThese loan extensions are only adding to the pressure in 2010, and 2011 is shaping up to be a potentially seminal year in the world of commercial real estate. “If values have rebounded sufficiently by then, the market could avoid widespread defaults. But if the market is still depressed, a significant amount of these maturities could go into default,” said Foresight partner Matthew Anderson.

The delinquency rate among CMBS loans, which hit 1.8 percent in March, could rise to 3.5 percent by the end of the year, and 6 percent by 2010. This is bad news for lenders, but even worse news for property owners who overbought at the peak. In addition to that pesky refinancing issue, most are already wrestling with the recession and rising vacancy rates, lower demand and decreasing rents.

But the significantly lower commercial lending volumes are much, much worse than decreasing rents. Combined with rising cap rates and tougher underwriting standards, many property owners will be left out in the cold when it comes time to refinance. If the value of the Hancock Tower in Boston has fallen by 50%, which seems likely, Broadway Partners and Lehman Brothers, the equity investor and mezzanine lender, respectively, are now completely wiped out. So much for location, location, location.

Disclosures: None

mortgage reits

commercial mortgages,

commercial+real+estate,

commercial real estate loans

ShareThis

ShareThis