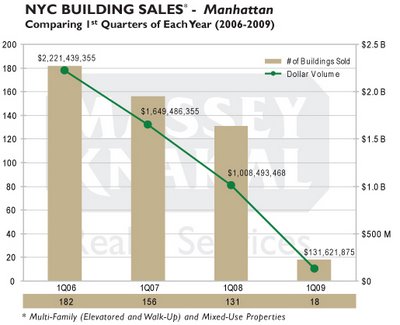

The worst years, 1992 and 2003, marked the end of recessionary periods and cyclical highs in New York City unemployment. The volume of sales in those years was 1.6%, which Knakal had always assumed was a market baseline representing only those people who had no choice but to sell due to death, divorce, taxes, insolvency, partnership disputes or the like. Then came the first quarter of 2009.

According to Knakal, if one were to annualize volume in the first quarter of 2009, in which only 233 transactions closed, sales volume for 2009 would be less than half of those recessionary 1992 and 2003 sales nadirs.

This graph tells only part of the story, that of multi-family and mixed use sales, but this part of the story is why Wall Street was dismantled on September 15th. In an earlier post about a month before then, I wrote about the bank that was ultimately undone that day, and one of the real estate deals that undid it.

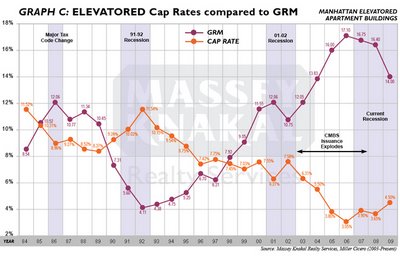

That 2007 deal, the largest ever for apartment buildings, was emblematic of the headlong stampede for yield during the credit bubble inferno. However, as Knakal’s data shows, Lehman’s deal for Archstone Smith was hardly isolated, and prices still have nowhere to go but south. If your vision is as bad as mine, click on the graph to get a better view shitstorm of what’s about to happen with New York City multi-family prices:

This graph’s innocuous title ignores the curiously shaped lines on the right, which look precisely like what they are: the jaws of the market about to snap shut on those who bought in Manhattan in 2005, 2006 and 2007. This is hardly news, and Harry Macklowe is already moving through the belly of this slithering python, but it indicates that prices still have another 50 percent to drop before Manhattan reaches the bottom!

For the unitiated, it’s not complicated. In the real estate world “GRM” stands for Gross Rent Multiplier, and it is roughly equal to a price/earnings ratio. “Cap Rate” is short for Capitalization Rate, which is an unlevered yield on equity. With P/E valuations still at all time highs, and yields still at all time lows, you’ve pretty much got the picture.

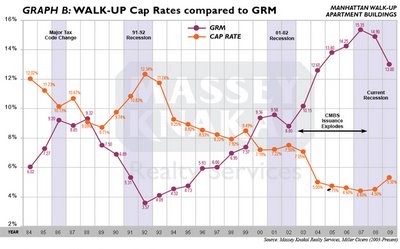

Valuations of walk-ups were similarly absurd, and they remain so, especially given the availability not of credit:

To complete this ugly picture, all you need to do is trot out a handy-dandy solo graph of historical cap rates for Manhattan apartment buildings:

Your view of how much prices still have to drop based on this particular graph just depends on whether you are an optimist (about 40%) or a pessimist (let’s skip that figure, shall we?)

Residential sales volumes in New York City are evidently not much better. Manhattan residential broker Coldwell Banker Hunt Kennedy closed its doors this week, after revenue dropped about 75%.

“The rest of the country has been in a real estate recession for several years,” an official at the firm said. “We entered a meltdown here starting last September that has been relentless.” Indeed, and the worst is yet to come.

commercial real estate

commercial real estate

commercial real estate loans

reit investments

apartment reits

ShareThis

ShareThis

{ 1 trackback }

{ 0 comments… add one now }