….And a taxable loss, dear believers, is still a taxable loss.

First, some housekeeping: This is a follow up post to the reader comments I republished in “Anthracite Post Generates Some Heat!” Those comments were originally written in response to the article entitled “High Risk, High Yield Strategy Keeps Anthracite Under Pressure”, or something like that. This post is also rather lengthy (but informative, I believe), so come back later if you’re almost empty.

The purpose of this post is to address those reader comments in more detail, first because their very premise is incorrect (that the REITwrecks article is inaccurate and must be “subjected to a high degree of scrutiny” due to the characterization of Controlling Class CMBS as BB-rated). And second, despite the forest-obscuring discussion of proprietary loss severity models and the not-to-be-trifled-with Math PhDs in the comments, the primary article’s main thesis remains the same and is fully intact: This weakening credit environment is simply no time to go out on a limb at the bottom end of the credit spectrum.

Having said that, the comments were greatly appreciated and I think a lot of people learned from them. So I do not wish to discredit the writer. I would simply like to set the record straight.

First, there are four investment-grade tranches (disregarding, for the moment, the various plus and minus flavors) in a mortgage securitization, they are the tranches rated AAA, AA, A and BBB. The tranches below these four are non-investment grade. These non-investment grade bonds are rated BB, B and CCC, the latter known among some as the dreaded “triple hook”. Last but not least are the bonds that are completely unrated. In the CMBS industry jargon, the below investment grade bonds (anything below BBB) are collectively known as the “B-piece”. The mix of these bonds and their individual rights are generally the same but vary specifically deal by deal.

It is the “B-piece” to which I was generally referring in the original article, and it was my glib refence to these bonds as BB-rated that gave the comments credibility. The B piece, frankly, gets all the attention because it is the hardest bit to sell. The reason is that the B piece investors are first in line for any losses, thereby insulating the more senior, investment grade tranches from all but the biggest of disasters.

Avoiding losses in respect of CMBS (or any structured debt) is completely analagous to homesteading on the beach for the afternoon. The higher the ground you occupy, the less likely you are to ruin your new Gucci’s when the tide comes up.

Why bother to go through all the trouble of carving the loans up in the first place? In theory, the borrowers get a better interest rate because the loan is split into various pieces which are then tailored to fit different investor constituencies, and that optimizes the price.

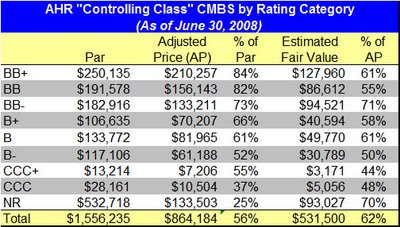

With respect to whether Controlling Class CMBS is rated or unrated, it was suggested that I take some remedial time to read the company’s reports so I could learn again? how these securities work. So I did, and naturally it didn’t take long to find the following: (edited for clarity) the things I do for you

Now, with respect to loss estimates, AHR clearly does purchase these securities at a discount to par, but they do not assume 100% loss of invested principle. In fact, “As part of its underwriting process hey joe, would you take a look? , the Company assumes a certain amount of loans will incur losses over time. In performing continuing credit reviews on the 39 Controlling Class trusts, the Company estimates that specific losses totaling $851,920 related to principal of the underlying loans will not be recoverable, of which $399,403 is expected to occur over the next five years. The total loss estimate of $851,920 represents 1.46% of the total underlying loan pools.”

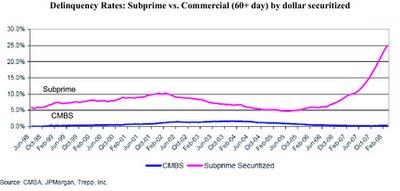

Continuing credit reviews are important, because historically low CMBS default levels in the years before the boom convinced many investors that CMBS structures were “over-enhanced”. These investors believed that recovery levels for junior note holders would remain higher than forecast, just as they had for subprime. Naturally, competition in the B piece world increased as a result, and buyers had to bid up the bonds in order to be successful.

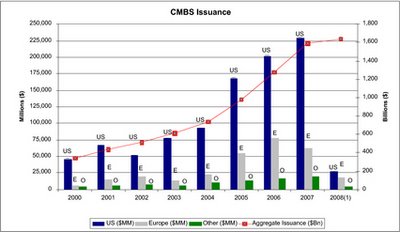

The “B” piece buyers had always been a limiting factor in overall CMBS issuance. Not only were there not that many of them, but they also had veto power over any individual loan that could decrease their chances of getting fully paid out. As more yield-hungy investors clamored for more “B” notes, they began to exercise their veto rights less often. Underwiters and issuers, who were only in it for the fees and cared not about repayment, were then able to stuff more and more junk into the pipeline, and CMBS issuance ballooned. (please read “How Could My Big Beautiful Loan Go So Bad, So Quickly“, including the comments)

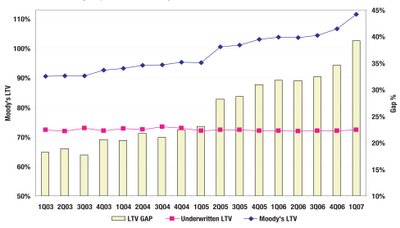

This volume increase resulted from a combination of huge demand and a commensurate decrease in underwriting standards, including (among other things), a relaxing of traditional loan-to-value criteria. Moody’s estimated that the gap between the Moodys LTV and underwritten LTVs reached record in the first quarter of 2007 (nearly 45%). The Moody’s estimate of actual LTV also reached a record of 106.5%. Who needs equity when lenders will give you more money than the property is worth?

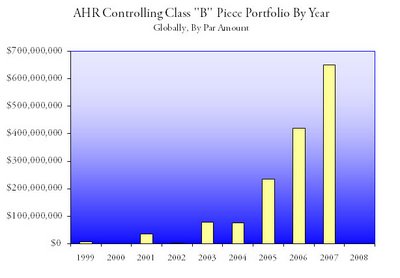

Moody’s warned that “Junior classes have become exceedingly thin, exposing them to the risk that if one of the larger conduit loans defaults, several classes at a time may be entirely wiped out.” It was in this environment that AHR was stepping up its purchases of Controlling Class “B” piece CMBS:

Now, some investors may take comfort in the fact that AHR alone gets access to the “top-secret” loan-level files. Presumably this gets combined with their own “top-secret” proprietary models, and they are thus able to divine the future by virtue of their uber geek Math PhDs who needs smack dealers, anyway? But having originated, structured and sold hybrid debt and equity (via conduits and securitizations, among other structures), and having bid on the wreckage as a principal after reality hits, I can tell you that it’s just not that easy.

If you’ve ever called the guy (or gal) who owns the controlling class and is in charge of the “work out”, you’ll discover that they often want to talk. This is because they know very little, and they need to know what you know. In one phone call, when I discussed the details of an obviously flawed underwriting on a mortgage behind a set of B notes, I was met with an incredulous “you’re kidding??” They then asked how I could possibly know about such micro-level minutiae, and I had but one very simple, honest answer: all I did was read the prospectus.

Disclosure: None at the time of this writing

ShareThis

ShareThis