Part of the answer lies in an earlier post I wrote about Mr. Market, an imaginary man who has helped created the buying opportunity of a lifetime in many REIT stocks. According to Ben Graham, the legendary value investor who imagined him, Mr. Market appears daily without fail to name a price at which he would either buy your assets or sell you his.

At times Mr. Market feels euphoric. When in that mood, he sets a very high price for your assets because he fears that you will snap up his interest and rob him of imminent gains. At other times he is depressed and can see nothing but trouble ahead. On these occasions he will set a very low price for your assets, since he is terrified that you will try to unload your interests on him, bringing him immediate losses.

Mr. Market has another endearing characteristic: He doesn’t mind being ignored. Consequently, Graham said you must heed one warning: Mr. Market is there to serve you, not to guide you. It is his pocketbook, not his wisdom, that you will find useful.

While we are free to determine the merits of Mr. Market’s wisdom on a daily basis, the accounting profession is entrusted with no such discretion. They are collectively the Joe Friday’s of the investing world: “Sorry m’aam, just the market value.”

Believe it or not, accounting rules require most Mortgage REITs to value the vast majority of their investment portfolios at whatever value Mr. Market thinks they are worth, no matter what mood he’s in, as if they were going to sell 100% of their assets – all at once – at whatever price the market would bear on any given day. This is what “mark to market” accounting means, and that is essentially how it works.

But what if these were not normal times, and Mr. Market was almost completely out of action, frozen by fear? What if Mr. Market were so completely incapacitated that he could not even quote a price, never mind buy or sell?

This is exactly what has happened, and the accountants are left with nothing but the Markit Group’s CMBX index to value many tranches of CMBS. The CMBX is partly what scared Mr. Market half to death in the first place, and it has drawn scrutiny for its lack of transparency and limited disclosure.

If Mr. Market was near sighted before, the Markit Group has helped turn him into Mr. Magoo, the very caricature of myopia.

While the dust-up between the the Markit Group and its critics will be fun to watch (See “Is Commercial Real Estate Really Dead?”), here is the important part for REIT investors: Mr Market’s Markit driven myopia results in accounting losses that are mostly temporary, non-permanent, and non-cash. Not only have these huge GAAP losses created frightening headlines, they have contributed to a great deal of confusion over the real valuation of financials. This confusion, and the fear related to it, has created a huge window of opportunity in certain REITs and financial stocks that simply will not last.

Here’s how it works: Because the securities being valued aren’t actually being sold, GAAP allows management some discretion in determining whether impairments can be considered temporary or permanent. If cash flows have actually declined and the asset is not performing as expected, management must classify the asset as permanently impaired. Permanent impairments flow through the income statement and drive taxable income lower. This is bad, because taxable income is what drives dividends. If taxable income declines, so do dividends.

However, if cash flow hasn’t declined and management determines that fair value will recover in a reasonable amount of time, they are given the discretion to classify those market value “losses” as temporary. Temporary impairments do not affect taxable income. They run through a balance sheet account known as Other Comprehensive Income, or Other Comprehensive Income (Loss), depending on who is doing the reporting, and they are reflected on the balance sheet as a reduction of stockholders’ equity. This only affects GAAP book value, not taxable income.

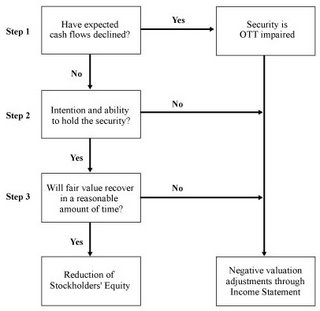

Making the determination is a three step process, and it goes like this:

(Diagram courtesy of Redwood Trust 2007 10K)

Because temporary impairments adjust a balance sheet account (stockholder’s equity), not an income statement account, temporary impairments are non-cash. Consequently, they have no real effect on income. They do not impact cash flow, taxable income or dividends, and no money is lost until the securities are actually sold – if they are ever sold. As long as the assets continue to perform as expected, your dividends will not be cut. Furthermore, any increase in Mr. Market’s myopic view of market value will cause those write downs to be written right back up.

What about that REIT that took the $180 million GAAP loss, despite having no non-performing assets across its entire $7.4 billion portfolio? That REIT is Northstar Realty (NRF), and Northstar almost doubled net cash flow from operating activities in 2007. This increase in cash flow helped contribute to dividend growth of $.10/share during the same period. It is cash flow and taxable income that should matter to REIT investors these days, not the myopic noise coming from the shareholder’s equity account.

Given its strong operating performance and the almost pristine credit quality of its portfolio, NRF would qualify as a REIT that’s not so wrecked. Most people would consider it a good investment in almost any environment, never mind one in which a myopic Mr. Market has discounted its dividend into the high teens.

The catch? As I wrote earlier, you must be able to ignore Mr. Market while you push the button and buy from him. Unlike the accountants, you are free to let him serve you, not guide you.

For additional information on a related accounting topic (FAS 159), see Muddled Mortgage REIT Book Values Create Opportunity

Disclosure: Long NRF

ShareThis

ShareThis