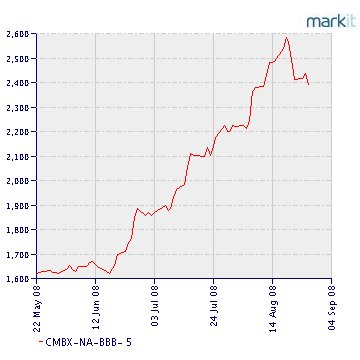

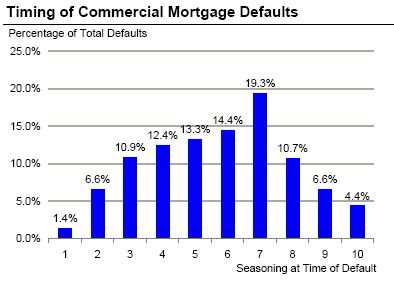

The relentless climb of the CMBX is partially the result of pure speculation. However, there is another factor at work as well. While the problems in residential mortgages are already manifest, there’s a notable difference between CMBS and their residential counterparts. Losses on RMBS typically decline as the loans age (or “season”), but losses on CMBS are largely driven by tenants’ ability to pay rent, and that can be undermined at any point by a slowing economy. The graph below shows that historical CMBS defaults typically peak seven years after issuance. This is “tail” risk, and tail risk for CMBS is rather long:

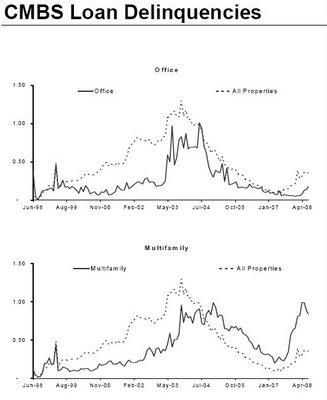

CMBS delinquencies are now rising, as the graph below depicts. To be fair, most of the delinquencies have been led by multi-family sector, which is partially tied to the single family market via failed condo conversions, and another large component of the increase in that sector can be traced to just one borrower. But the slow rise in defaults in CMBS generally is nevertheless causing a great deal of hand wringing.

That CMBS defaults will rise is not in dispute, simply because they have been at historic lows for much of the past year. Estimates of how high defaults could rise vary widely though, and obviously that affects estimates of how high they may or may not travel up the CMBS capital stack. And “tail” risk is no secret; Mortage REIT portfolio managers account for it in their loss assumptions.

However, while fundamentals are holding up and remain firm, there still is a pervasive sense of fear among CMBS investors and real property investors alike. Costar, in its August 26 article entitled A Dud of a Thriller? Commercial Real Estate Drama Lacks a Killer quoted Philip Conner, of Prudential Real Estate Investors, who compared the market to the Samuel Becket play “Waiting for Godot”.

In a report entitled “Waiting for Distress” (I don’t have a copy), Connor wrote that “though signs of distress remain largely confined to highly leveraged deals consummated at the peak of the investment cycle, in late 2006 and early 2007, there is an undeniable and growing sense of anticipation among investors that U.S. commercial property values are poised to fall and that widespread distress is just around the corner.”

However, Connor noted that in the Samuel Beckett play, Godot never actually appears onstage. “His off-stage presence, whether real or imagined, and his expected arrival largely dictate what does and does not happen in the play.”

Connor contends that most of the distress is likely to remain “off stage” in the capital markets. However, capital markets is very much “on-stage” for Mortgage REITs, and just as the abundance of ready and available credit pushed asset prices above their fundamental value, so too will the lack of it push prices below their fundamental, intrinsic value. And when the bottom is finally notched, Godot won’t be there to ring a bell for us either.

Click here for an updated Mortgage REIT list, including current yields. Data compilation courtesy of Chris Germain in San Francisco

Disclosure: This play is more interesting.

Graphs courtesy of Markit; Morgan Stanley

ShareThis

ShareThis