In Ever Increasing Numbers, Vulture Investors Are Circling Commercial Mortgages, Citing a Price/Value Disconnect, But Expect Book Values to Remain Under Pressure as More Distressed Trades Begin to Hit the Tape.

Petra Real Estate Opportunity Trust, a New York-based REIT intending to invest in commercial mortgage loans, recently filed a registration statement for an initial public offering with the U.S. Securities & Exchange Commission. Behind the REIT is Andrew Stone’s Petra Capital Management, a $3.7 billion hedge fund focused on real estate debt and related financial instruments. Through its IPO, Petra is looking to raise $200 million, alongside a private 144a offering of $250 million which commenced on June 4th.

Stone began his career in 1981 at Salomon Brothers in the Mortgage-Backed Securities Department, where he became a senior trader responsible for the day-to-day management of the mortgage-backed securities trading group, which was headed by the legendary Lewis Ranieri. Stone and his team were responsible for structuring and trading the new real estate finance products that Salomon Brothers was then bringing to the market. Those products became the lifeblood of the mortgage market we now know and casually took for granted until late 2006.

After a series of senior real estate finance related positions at a number of Wall Street firms, Stone eventually landed at CSFB in 1995, where he formed the firm’s Principal Transactions Group, or the PTG, which was Credit Suisse’s global real estate business. The PTG also functioned as a proprietary investment vehicle within Credit Suisse to invest in mortgage- and asset-backed and other real estate-related debt and equity. Stone was eventually forced out after management became concerned that he was literally betting the bank.

Stone then formed Petra, which had assets under management of approximately $3.7 billion as of March 31, 2008, consisting of commercial real estate finance investments of approximately $1.6 billion and approximately $418 million of equity. The Petra Fund has generated cumulative net returns since inception of approximately 23%, which ain’t too shabby. Petra is named after a city in the Jordanian desert, which bible scholars believe is the place where true believers can go in order seek refuge after the arrival of the anti-christ.

With a successful hedge fund, creatively named to poke a finger in the eye of his former bosses, and a career of notable accomplishments behind him, why would Stone want to go to the trouble and hassle of organizing a lowly REIT, particularly one focused on the nuclear wasteland in mortgages? Well, it turns out that a quick look through the prospectus is both enlightening and interesting reading.

Petra’s new REIT describes itself as: “a newly organized, internally managed commercial real estate finance company formed to take advantage of inefficiencies and dislocations in the credit markets by opportunistically acquiring and originating commercial mortgage loans and other real estate-related assets that generate risk-adjusted returns that currently exceed those typically expected under normal market conditions.”

These are obviously dangerous areas for investing right now, nevermind in an IPO for a newly organized commercial mortgage REIT, but Petra looks to be calling a bottom with this new offering. In the filing, Petra says it thinks that “current conditions in the credit markets have created investment opportunities of a magnitude that arise infrequently in the financial markets.”

The draft S1 goes on to say that “concerns that began with the deterioration of the credit quality of sub-prime residential loans and other factors have resulted in an illiquidity contagion that has impacted the values of commercial mortgage loans and other real estate-related assets despite, in our view, the lack of a deterioration in the fundamentals of such loans and assets”.

The S1 compares the current credit crunch to past market disruptions, such as the stock market crash of 1987, the S&L crisis, the Russian debt crisis, LTCM and the terrorist attacks on September 11, 2001, all of which turned out to be significant opportunities for intrepid investors.

Stone is one of them, and he is in a rush. Petra says in the filing that it believes the current opportunity will exist only for “a relatively limited time period”. As he knows from experience, by the time the panic in the market catches up with underlying fundamentals, savvy opportunists like Stone will have already picked over the bargain bin.

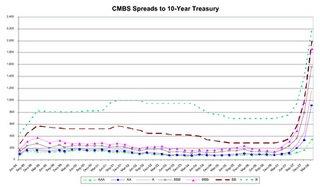

The price/value disconnect is Petra’s arbitrage, and it has never been greater in commercial mortgages. As the prospectus shows, spreads for 10-year AAA CMBS are approximately 150 basis points wider today than they were only nine months earlier, as illustrated below, even after a recent minor recovery.

Despite these unprecedented spreads, nothing has changed in commercial real estate fundamentals, which remain intact. Petra’s whole investment thesis is their belief that the widening spread in the commercial real estate mortgage loan market is driven by illiquid credit markets, not by deteriorating credit fundamentals.

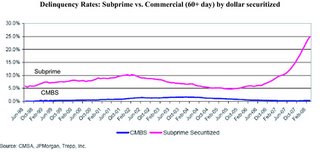

As they illustrate in the Petra prospectus, while yields on CMBS continue to widen, CMBS delinquency rates remain as low, or lower, than before the crisis began. The disclocation in credit quality between residential subprime and CMBS has created an Alpha that hedge fund managers can only dream about:

In addition to the low commercial mortgage delinqency rates (which I have also written about extensively), Petra points out that further evidence of strong credit fundamentals in commercial real estate mortgage loans is evident in the total number of CMBS upgrades by Fitch Ratings. As of year end 2007, the number of upgrades continues to significantly exceed the number of downgrades, with Fitch having upgraded 776 classes of U.S. CMBS during 2007, compared to 70 classes that were downgraded. This is an upgrade/downgrade ratio of 11:1.

Stone is not the only one to recognize this disparity. There are now heaps of private hedge funds beating the bushes for high net worth investors and pension funds wanting to invest in this space. North River Investment Management, for example, just launched its first commercial real estate private equity fund, North River Opportunity Partners I LP with $100 million of committed capital. The fund is but one of dozens that will also initially pursue investments in discounted pools of commercial mortgage debt and originate first mortgage and mezzanine loans on commercial real estate properties.

Echoing the Petra theme, the North River prospectus notes that “current economic pressures have led to wide-scale devaluations of assets such as commercial mortgage-backed securities. At the same time, due to capital constraints, many traditional lenders have retreated from commercial mortgage financing, even for highly credit-worthy properties,” said Jonathan Kaye, co-founder of North River.

So what does this mean for all of you REITwrecks bargain hunters out there? As these new funds rush into the current liquidity vacuum, attracted by commercial mortgage yields that are dramatically mispriced relative to underlying fundamentals, valuations will remain under pressure as distressed trades start taking place in increasing numbers. The effect of these transactions on “mark to market” valuations will depress portfolio values throughout 2008 and possibly well into 2010, even though the underlying performance of the collateral will remain strong and dividends continue to get paid.

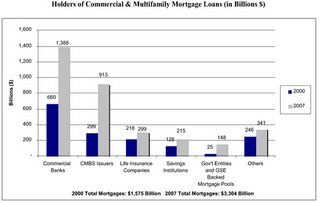

As the chart below shows, commercial banks and CMBS issuers are currently the largest holders of commercial and multifamily mortgage loans, and these holders are under increasing pressure to minimize their exposure to these asset classes. Consequently, they may often sell the loans at discounts in order to maintain their liquidity in this environment (just like a margin call), particularly the CMBS issuers who got stuck with the loans when they could no longer securitize them.

Depositing those dividends is the easy part; stomaching this roller coaster ride isn’t. I don’t believe it will get any easier any time soon, but the ride will eventually come to an end, and I think you will be glad you bought that ticket.

Click here for an updated list of Mortgage REITs, including current yields

Click here for an updated list of Apartment REITs, including current yields

Click here for an updated list of Office REITs, including current yields

Click here for an updated list of Retail REITs, including current yields

Click here for an updated list of Industrial REITs, including current yields

Click here for an updated list of Storage REITs, including current yields

Click here for an updated list of Healthcare REITs, including current yields

Click here for an updated list of REIT dividends being paid in stock, including current “yields”

ShareThis

ShareThis